|

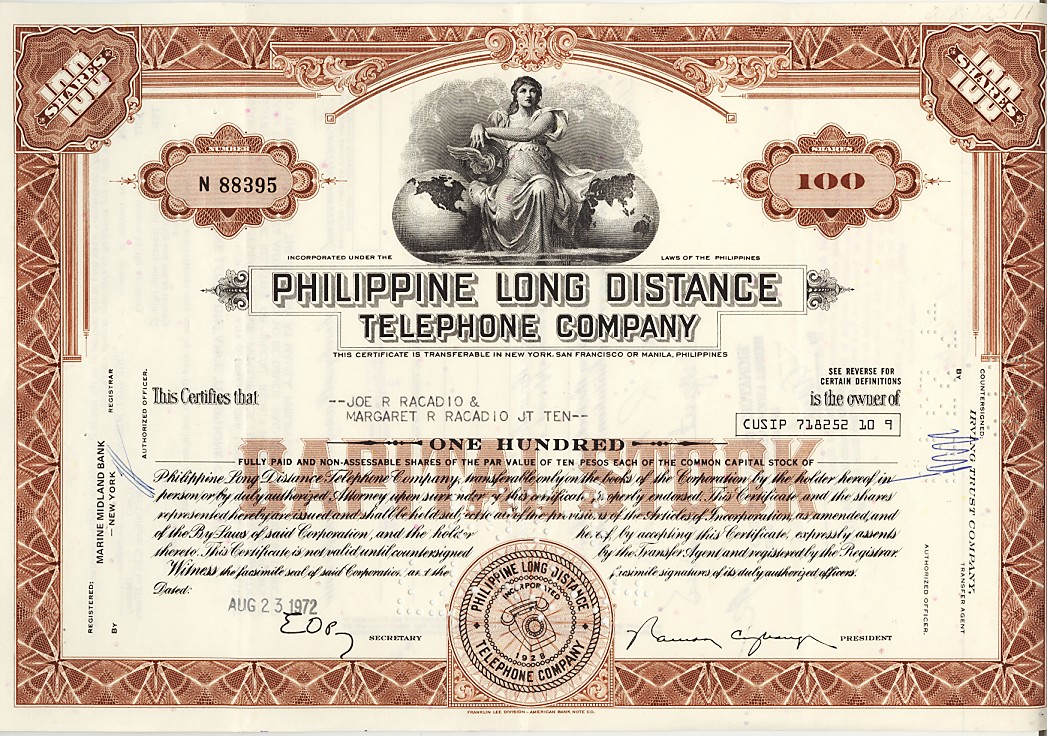

| PLDT stock certificate |

Let's get down to basics.

When a business entity is formed as a corporation, you need some amount of capital, let's say, 100 m pesos. Let's suppose there are five persons--the incorporators--and each of them equally ponies up 20 m for the initial capital. Their share of ownership of the corporation would now be represented by--well, shares of stock of the corporation.

Theoretically, they could issue one share each to themselves, with each share representing 20 m, for a total of five shares. That amount represents the par value, or the initial valuation, of each share.

But then, down the road, one or some of them would like to sell their share of the corporation to the other incorporators, to outsiders, or to their kids as inheritance. Dividing a share to several persons would be inconvenient and impractical. To anticipate this probability and for a host of reasons (like conducting an initial public offering or IPO much later), the corporation might as well issue 100 million shares with each share now having a par value of one peso.

How convenient. But one peso, while the most common, is not the only possible par value. For example, most bank stocks have a par value of P10, while the speculative ones--the so-called penny stocks--have the ridiculous par value of 0.01 or one centavo. Back then, it might have made sense when you could buy something out of your ten centavos (like a bottle of soft drink, or the minimum jeepney fare).

Market stock prices on the other hand, are those that appear as transactions at the Philippine Stock Exchange (PSE), and the quoted price of a given stock is what the buyer (bid price) or the seller (ask price) thinks the share price of that particular company is, or should be. As the company's business flourishes with time, the perceived or market value would rise above par, and if the company has been in existence long enough, the market value would be far different than its par value. PLDT (PSE:TEL), which last traded at P 2988/share on March 27, has a par value of only P 5. If the company is going down the drain, the market value could tumble below its par value.

The issued equity amount you see in balance sheets, is based on par value.

Watch out for dividend announcements. A cash dividend of 10% refers to that percentage of the par value, not the current quoted prices.

By virtue of some corporate actions, the par value can change. If a company has been bleeding red ink for years, its capital (equity) would be depressed so much or it may turn negative. The board of directors may then decide to lower the par value to "wipe out" the deficit, which is actually an admission of permanent loss. Thus, if the par value started with one peso and ends up with 10 centavos and you are a stock holder, you lost 90 centavos per peso of your capital. Example, the par value of Atlas Consolidated Mining and Development Corp (PSE:AT) share has been lowered to P 8 from the original P 10.

The same board may also decide to split up its shares by lowering the par value to a fraction of the original. This is to increase the number of shares available in the open market, and to make the share prices to be perceived as affordable. But that doesn't really change the fundamental ownership structure of the company.

An increase in par value is also possible. This is usually resorted to when the major owners would like to enhance the image of a corporation from that of a speculative firm (which has a par value of say, one centavo) to a more established kind. This usually happens when a dormant firm which started as a speculative oil or mining exploration firm is taken over by new owners who have different plans of business than the original. Recent examples abound, and if one understands the situation and acts quickly, one could profit handsomely in a short time.

Others are made higher for accounting and trading convenience since it would be easier to handle millions rather than billions of shares.Large companies like conglomerates which expect a significant fraction of their shareholders to be institutional foreign funds prefer larger par values (and market prices) since when prices are converted to other major currencies, the holders won't be talking of pennies or fractions of a dollar or euro. For example the par value of Ayala Corporation's shares (PSE:AC) is now P 50 whereas it used to be one peso.

You are more concerned of course with market quotations for trading purposes. However, it pays to know the par value to understand corporate actions which lead to better appreciation of investing in stocks.